Salary Rule Computation

Here we can define the Salary pay heads for the Employee

Introduction

Salary Pay heads (Pay components) can be created in this Master Salary rule Computation

Introduction

Over View :

- The Salary Rule computation window is used describe the Rule type for Pay heads.

- In this master window we can Create Rule types for Employee Earnings , Contributions and Deductions.

Business case :

- In the Organization we can maintain multiple Rule types for Employee Salary. It may be a Contribution , Deduction and Earnings.

- We can Create all the Rule types in the same window and we can mention the rule type category like variable, Range, Formula and Fixed Amount.

Salary Rule Computation Tab's

Salary Rule Computation

CRITICAL FIELDS :

1) Rule Type: We can name the pay head( Pay Component) what we are creating Eg : Basic/HRA/DA/PF.

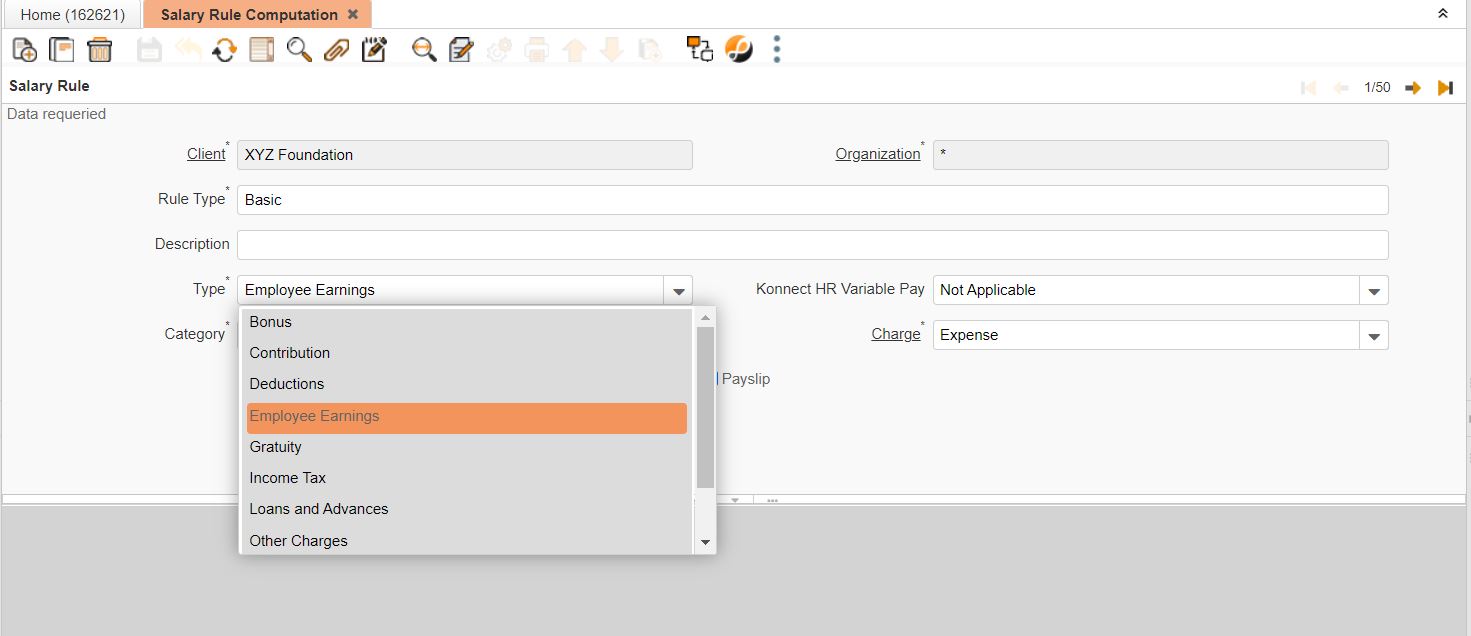

2) Type: We can select whether this pay head is Earning/Deduction/Contribution/Overtime/Loans and Advance/Bonus/Income Tax/Gratuity.

a) Bonus - Used to maintain the Salary Rule Type Based On Bonus Eg : Special Bonus

b) contribution - Used to maintain the Salary Rule Type Based Contributions Eg: PF , ESI

c) Deductions - Used to maintain the Salary Rule Type Based On Deductions Eg : PF , ESI

d) Employee Earnings - Used to maintain the Salary Rule Type Based On Earnings Eg : Basic, DA, HRA

e) Gratuity - Used to maintain the Salary Rule Type Based On Gratuity

f) Income Tax - Used to maintain the Salary Rule Type Based On Tax Deduction, It is applicable for Ta paying employees

g) Loans And Advances - Used to maintain the Salary Rule Type Based On Loans and Advances

h) Other Charges - Used to maintain the Salary Rule Type Based On Other Heads

i) Over Time - Used to maintain the Salary Rule Type Based On Over Time . Eg : OT

j) Reimbursements - Used to maintain the Salary Rule Type Based On Reimbursements

3) Category: We can Select whether the pay head is Variable or it is fixed, It is Calculated by formula or it is calculated by Range.

a) Fixed Amount - Used to maintain the Fixed Rate.

b) Formula - Used to maintain the Rule Type Based on Formula Calculation

c) Range - Used to maintain the Salary Rule Type Based Range Eg : PF

d) Variable - By using this field we can change the Amount in Salary Structure For Individual Employees.

NON-CRITICAL FIELDS:

1) Client: Displays the name of the client

2) Organization: Displays the name of the Organization within the client

3) Description: Can be used to maintain the description

4) Konnect HR Variable Pay: It can be maintained as Not applicable but can be used if Operator Production or Piece Rate Calculation or Shift Based Allowance.

a) Activity Rates : Used to maintain the Activity Based rule type and calculations

b) Attendance Bonus : Used to Create the Attendance based Rule type creation

c) Not Applicable : Not Used

d) Operator Production : Used to create the Production based Rule type

e) Piece Rate Calculation : Used to create piece rate based rule types

f) Shift Based Allowance : Used to create the Shift Based Allowance Rule Types

5) Charge: Can be maintained for charge like salary Expense

Range and Formula

Description :

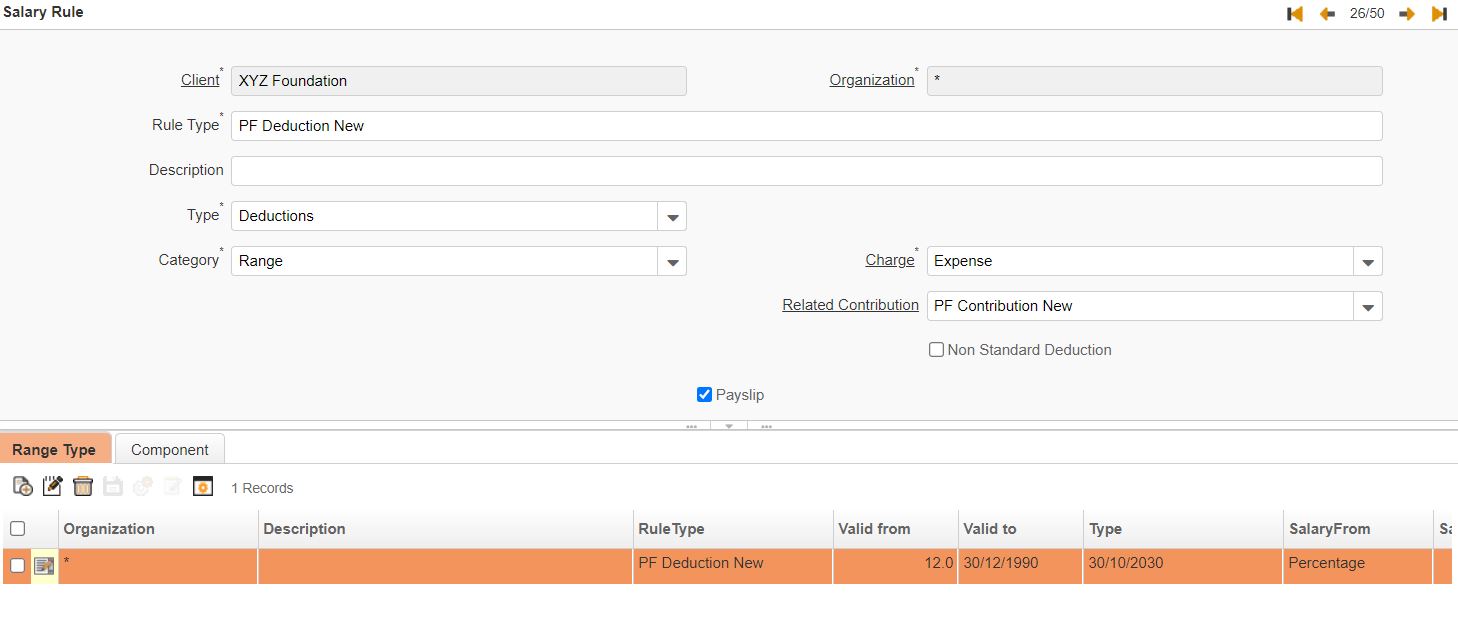

1) While choosing a category as Range, It will populate two Sub tabs (Range and Component)

In the component subtab, we can choose multiple rule types in which we want to calculate. Eg (Pf is calculated from Basic)

In Range, We can Maintain the salary from and salary to the range. In which we can calculate the percentage. Eg. (If earnings are between 0 to 15000 need to calculate 12% for PF).

2) While choosing a Formula, It will Populate Formula Subtab where we can choose the rule type in which we are calculating the formula for this pay head. Eg.(HRA will be calculated from Basic)

RANGE CRITICAL FIELDS:

1) Salary From and Salary To Where we can set the salary from and Salary to

2) Type: In which we can choose the percentage or Amount to be calculated for the range mentioned

3) Valid From and Valid To Date: Where we can Set the period in which this range is valid.

FORMULA CRITICAL FIELDS:

1) Rule Type: In which we can choose the Primary rule type, from that we are using the formula to calculate

2) Valid From and Valid To Date: Where we can Set the period in which this range is valid.

COMPONENT CRITICAL FIELDS:

1) Component: In which we can choose the Primary rule type, from that we are calculating.

Activity Rate

Critical Fields :

- Business Partner : It used to mention the Employee Name

- Activity : Here We can mention The Activities like process or Piece rate Operations.(It is an separate Master)

- Rate : It is used to mention the rate For That Particular activity

- Minimum Quantity : Used to set the minimum activity completion

- Deduct Min Qty : Used to given the Minimum Quantity Deduction

- Continuous Target : If the Activity wants to set the Continuous Target , Enable This Check Box.

- Day Count : Used to maintain the Days Count For Continuous Target.

If(daycount == 0), there is no target or incentive check the qty against the min qty and proceed.

If(daycount = -1), target need to be achieved for all days

If(daycount > 0), target needs to be achieved for said days, Continuous or otherwise depends on the following

If(iscontinuous) -> Target needs to be achieved Continuously according to day count.

If(!iscontinuous) -> Target need not be achieved continuously but has to be achieved according to day count.

Attendance Bonus

Salary Rule

CRITICAL FIELDS:

Rule Type: It is to create the rule type name eg. Attendance Bonus

Type: For Attendance Bonus it should be Employee Earnings

Category: Attendance Bonus will calculate automatically so the category maintained as a Variable

Konnect HR Variable Pay: Need to maintain Attendance Bonus here

Customized Days: If Attendance Bonus needs to calculate based on calendar days that need to maintain customized days as -1 so it will automatically consider calendar days instead of customized days

NON-CRITICAL FIELDS:

Description: It is to maintain the reference if any

Attendance Bonus Range

CRITICAL FIELDS:

Percentage From: Need Maintain minimum percentage of working days to calculate bonus

Percentage To: Need Maintain Maximum percentage of working days to calculate bonus

Amount: If the attendance of employee meets with the above mentioned range need to mention the bonus amount to be paid here

Total Bonus Amount: This check box needs to maintain to pay the bonus totally for month if it is unchecked the same amount paid per day.

Variable : This check box is used to maintain variable amount in Salary structure based on individual employee.

Attendance Count : We can use this check box for giving attendance based allowances like bus fare, meals allowance.

this is used to maintain half day calculation also. (if they present half day also get bus fare.)

NON-CRITICAL FIELDS:

Sequence: It is to maintain sequence of document